AR Daily Procedures

The AR daily procedures consist mainly of taking payments and balancing the bank deposit. The first step is to complete the invoice posting. That gives you the total money taken at the cash drawer. In AR, we add payments on account and that gives you the total being deposited into the bank. AR daily procedures is broken out into the following steps:

- Payments on Account

- AR Posting - Preview

- Adjusting Entries for Bank Balancing

- AR Posting

- Security

Payments On Account

AR > Transaction Processing > Add > Payment

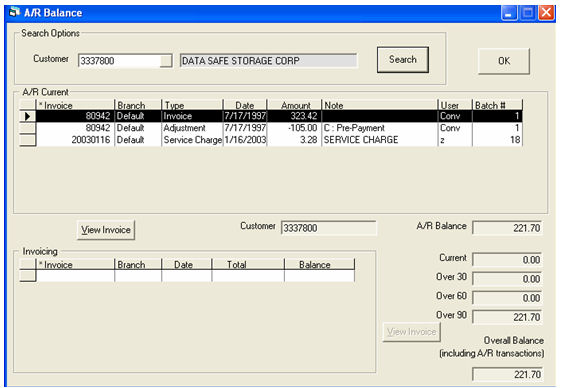

Once an invoice has been posted, payments are now made through AR. To check a customer's balance use the Balance option in the AR menu. The same Balance button is available while on the invoice header and on the credit tab of Customer Maintenance.

This customer has one invoice which they made a partial payment on and a service charge. They are here to pay both.

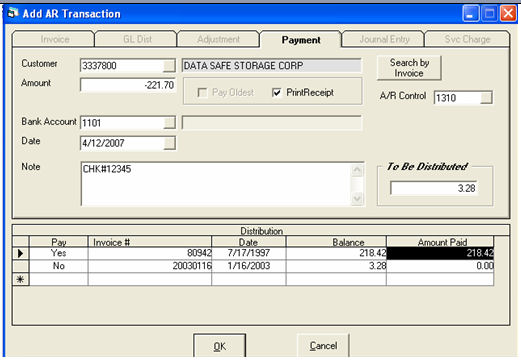

From AR Transaction Maintenance, we select Add and then payment.

Customer: The browse button is available to search customers, plus a Search by Invoice button will help when you cannot figure out what customer this is, but you have the invoice.

Amount: The amount being paid.

Bank Account: Defaulted from AR variables; normally does not change.

Date: Today’s date.

Note: Check number or similar. This is kept in AR history.

A/R Control: Defaulted from AR variables; normally does not change.

To be Distributed: The system will show the amount of money left to be distributed.

Pay: To change the yes/no, you can double click, use F2, or press Y/N.

Invoice #: Filled in by the system, but on new lines (marked with an asterisk at the bottom) you can type in any invoice number wanted.

Amount Paid: Defaulted to the invoice balance, but can be overridden. When To Be Distributed is zero, you can click OK.

A variation of the payment is also used to clean up customer accounts. When you have a customer whose overall balance is zero, but it is made up of many different invoices/payments/adjustments etc. You can do a ‘Zero Payment’ so the transactions will drop. In a zero payment, the amount is 0.00 and, in the distribution grid, each invoice is paid in full, whatever the balance column shows. Some invoices will be credits and some will be debits, but overall they will balance out to zero. After you have successfully done the zero payment/AR Posting/Drop Paid Invoices, they should all disappear from the balance screen, or Aged Trial Balance.

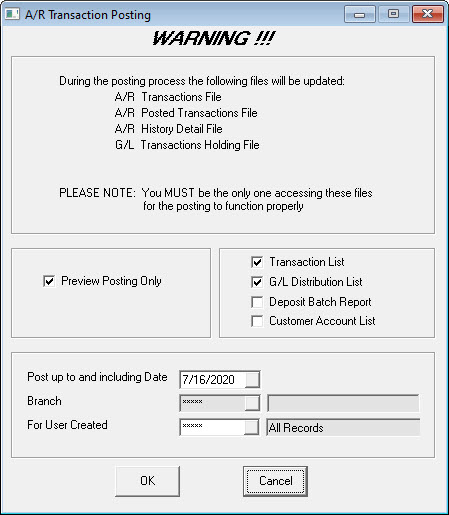

AR Posting - Preview

The reason for running the posting in preview is to help you verify your entries without printing. The print option is always available if necessary. On the posting screen we have options for three reports: Transaction List, G/L Distribution List, and Customer Account List. It is highly recommended you print the first two reports, but the third is more commonly used at month end when adjustments are being made. The Customer Account List will show how each account is affected by the transactions being posted. It is very helpful when making adjustments, but not necessary on a daily basis.

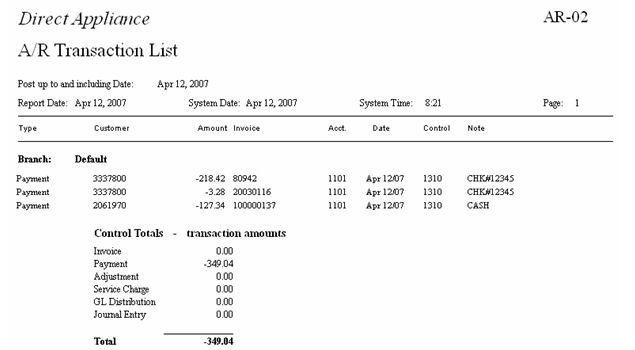

The Transaction List is a detailed listing of each entry, it is mainly used when errors occur and you need to research each transaction.

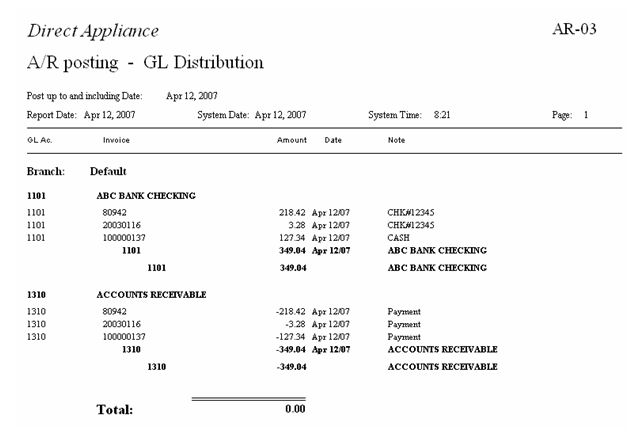

The GL Distribution List shows how each GL account is affected by the posting. Primarily we are looking at the bank. We must verify that what we are telling EPASS is going to the bank is actually what we are depositing into the bank. This is very important, or end of month balancing will be a nightmare.

Adjusting Entries for Bank Balancing

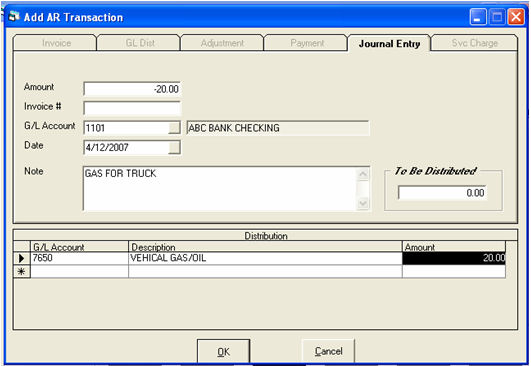

For multiple reasons, you will have to make adjusting entries to the bank to make EPASS balance to the true bank deposit. Maybe they took $20.00 to buy gas. These types of entries are made through journal entries.

AR Transactions > Add > Journal Entry

In this case, the amount is negative because we are taking money out of the bank. It is very important that you understand when to use a positive or negative amount. If you are unsure, ask your accountant as they are the only ones that can truly tell you how they want entries in your books.

Other uses for a journal entry would be for an unexpected co-op check, this would be a positive amount to the bank and a negative amount to a revenue account, or a COGS account. Again your accountant is the only one who can properly advise what accounts to use.

AR Posting

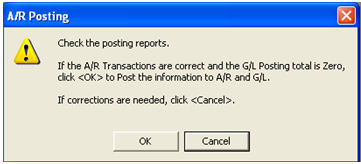

After you have done the AR posting in preview and the amounts are correct, you are ready to run the true AR posting. This is the exact same as the posting in preview, except when you uncheck Preview, the reports will automatically be sent to the printer and you will have the following screen appear:

Do NOT click OK until you have the reports in hand and have verified they are correct. There is no way to reverse a posting. After you click OK, the system will complete the posting and give you a posting batch number. Please write this number on the front of your posting report. The batch number is not printed on the report because your reports print before you accept the posting.

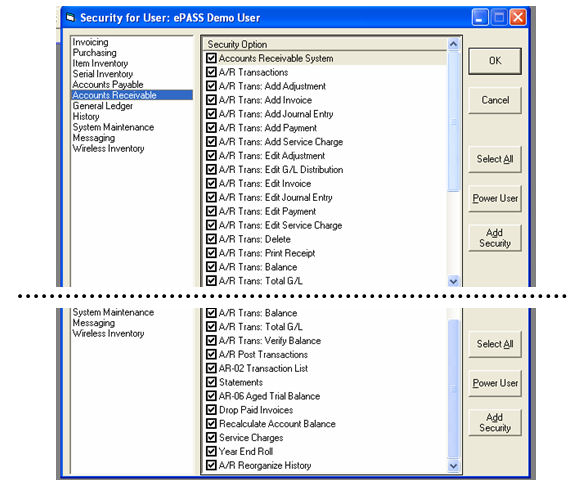

Security

There are separate security settings for AR Transactions, add and edit of each transaction type in AR Transactions, in addition to each step, like posting, being its own security level. This will allow full customization of each and every employee.